This essay/case study has been written as part of a professional PhD qualification and explores the main reasons why British Home Stores (BHS) failed, as well as the factors contributing to this failure. To achieve this goal, the author analyses BHS’s strategy by focusing on its branding practices, customer relations, sales channel utilisation, and overall leadership quality.

1. Introduction

The recent COVID-19 pandemic has demonstrated that the absence of resilience to highly adverse macro-environmental conditions may lead to failure even in the case of the strongest market performers (Amankwah-Amoah et al., 2021). With such multinational corporations as Hertz, Gold’s Gym, Lufthansa, and Virgin Atlantic filing for bankruptcy in 2021 and 2022, it has become evident that major market disruptions can easily kill thousands of smaller firms and adversely affect global economies. While such external forces as economic crises or disruptive innovation trends act a substantial role in the collapse of past market leaders, such authors as Liu and Si (2022) and Yang et al. (2022) noted that retail failures can be largely attributed to a preceding history of sub-optimal strategic choices and managerial myopia. This perspective implies that a thorough analysis of such possible antecedents can help other companies build resilience and avoid the threats posed by large-scale macro-environmental challenges. This essay attempts to answer the question ‘Why did British Home Stores (BHS) fail?’ by exploring the causes of its retail failure and identifying the main factors contributing to this outcome, as well as potential strategies that could have been applied to avoid this outcome.

2. Company Background

British Home Stores was founded in 1928 and had 160+ stores in central areas across the UK as well as a number of international subsidiaries (Pilkington, 2019). By the late 1990s, its financial performance was appraised as satisfactory with the company employing more than 11,000 workers and opening new retail outlets. In 2000, BHS was acquired by Sir Philip Green who later sold it to Dominic Chappell for £1 in 2016. Within this period, the financial performance of the chain was gradually declining, which probably led to this controversial decision. With Dominic Chappell having many cases of bankruptcies and being repeatedly accused of tax evasion prior to the purchase, the retail failure of BHS occurring 13 months later was deemed as a logical outcome by many experts (Wright et al., 2018). This person explicitly stated that they extracted £2,627,643 from this chain via affiliated organisations. It can also be noted that Dominic Chappell was later found guilty of serious tax evasion in 2020 and was sentenced to spend six years in prison for these violations.

With that being said, the assumption that poor governance quality was the sole reason for BHS’s retail failure may be seemed questionable (Shah, 2018). On the one hand, Sir Philip Green acquired a number of other chains in the early 2000s including Burton, Debenhams, Miss Selfridge, Topman, and Topshop. Most of these brands were later sold to ASOS and other corporate groups in 2020-2021 with similar problems such as declining profitability and controversial brand equity. This implies that most of these companies with a long history and substantial past success reached the same outcome, which may be attributed to poor governance. On the other hand, strong criticisms were voiced by experts prior to these retail failures regarding the inability of these brands to adapt to new market challenges despite showing top performance in the 2000s and competing with such market leaders as M&S (Tricker, 2019). This may indicate the presence of multiple problems decreasing the resilience of BHS and similar companies to external factors such as the global financial crisis, COVID-19 or increasing competition from international rivals entering their domestic markets. This further implies the need to consider all possible retail failure factors and potential ways their influence could have been mitigated.

3. Strategy Analysis

3.1. Consumer Needs Recognition

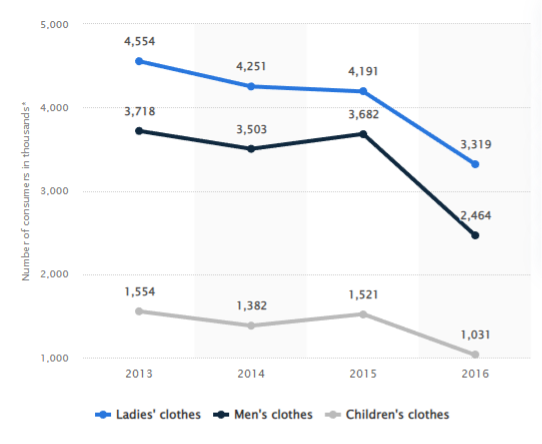

In the early 2010s, BHS was already in debt while also losing contact with its customers. Its main audience included 40+ female shoppers interested in low-cost products, which put it into the cost leadership competitive strategy according to Porter (1980). As a result, BHS was exposed to severe competition with Primark, Tesco, and other similar brands having greater economies of scale and a stronger offering of products and services. The following graph from Statista (2023a) clearly shows how customer numbers had dwindled between 2013 and 2016 with some consumer categories losing up to 33% of clients. This implies that the problems of BHS’ financial performance stemming from its ineffective segmentation, targeting, and positioning (STP) choices have been present for several years preceding its demise. As opposed to M&S focusing on the same age category and having a clear ‘Mrs M&S customer persona’, the analysed brand failed to identify ‘Mrs BHS’ in terms of specific demographic, psychographic, and behavioural characteristics (Atkinson, 2016).

Figure 1: BHS Products Ranked by Number of Customers in the UK (Thousands of Customers)

Source: Statista (2023a, n.p.)

Five years before the retail failure, both of these high-street brands had comparable resources and equally problematic STP effectiveness according to Osborne (2011). More specifically, these companies had outdated store interiors, questionable customer services, higher pricing for similar items, and controversial product designs. BHS failed to recognise its customer needs in terms of offerings range since best-bargain items included single-time medium-involvement purchases such as coffee mugs or toasters while the cost of clothes, accessories, and homeware was generally higher than that of M&S. However, this 2011 publication criticises both organisations due to the lack of effective loyalty programmes and poor inventory management. A later article by Wood (2017a) defining a five-year revolution of UK-based high-street stores demonstrates a radically different situation in the case of M&S that managed to catch up and develop a unique selling proposition as well as solid digital marketing competencies. As opposed to Woolworths and other failing leaders, they focused on their brand strength and addressing the needs of their core customers rather than trying to simultaneously maintain leadership in multiple niches against strong rivals such as Ikea in the homeware segment and H&M in the apparel sector.

3.2. Branding Practices

By the moment of its failure, BHS was a discount brand that had no unique personality sought in such UK brands as M&S, Morrisons, Sainsbury’s or Tesco (Driver and Thompson, 2018). This chain was selling generic clothing and household products accompanied by some basic beauty products and electronics. By the early 2010s, the same range of items was available from most rivals with online retailers going beyond these standardised offerings and providing the possibility to purchase almost anything with overnight delivery. Such brands as Tesco were also developing their own products and services while also experimenting with experiential marketing techniques (Hayes, 2018). In comparison, the offerings of BHS seemed bleak in both out-of-town large stores and smaller stores located in city centres. In combination with high rental costs, decreased consumer traffic effectively created a self-sustaining loop of financial losses that made the retail failure inevitable beyond a certain point. The size of BHS’ brick-and-mortar presence could be seen as a major problem in this sphere since it largely ignored online sales but failed to properly utilise experiential marketing techniques to lure consumers to its stores.

In terms of the 4Ps the marketing mix of BHS was largely unbalanced since its mid-range pricing and high-street place were not supported by proper promotion and product dimensions (Morris, 2018). This lack of focus created a diluted brand image where the studied company was recognised as another generic brand that did not fall into a certain category. For example, the aforementioned M&S was focused on medium-income and high-income female audiences reflected in its ‘Mrs M&S’ customer persona. Similarly, John Lewis was recognised as a provider of high-quality products while Primark had the best price-value ratio in the market (Johnson, 2019). In this increasingly competitive market, BHS had no clear brand proposition based on any of the 4P dimensions and failed to develop a well-defined STP strategy. As a result, it failed to compete against such discount brands as Primark in the mass-market niche while higher-income consumers did not see any unique benefits in comparison with M&S or John Lewis.

3.3. Sales Channels Utilisation

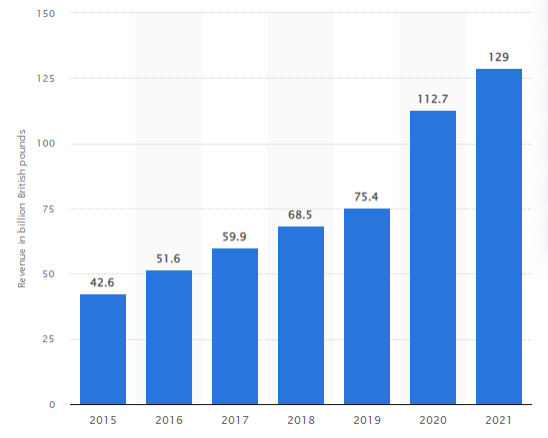

As seen from the following figure from Statista (2023b), online sales revenues have been growing at an increasing rate in the two years preceding the BHS retail failure.

Figure 2: E-Commerce Revenues in the UK (Billion £)

Source: Statista (2023b, n.p.)

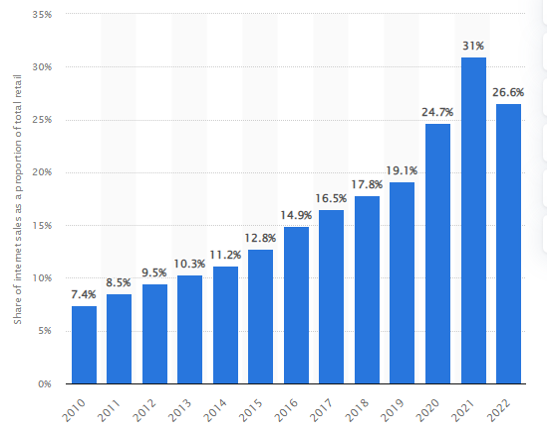

Similarly, the growing share of online sales in the UK during the 2010s indicated that all local retailers had to consider this market trend (Statista, 2023c). However, BHS largely ignored the increasing significance of social media, e-marketing, and other technologies allowing brands to maintain two-way communication with their audiences and collect their feedback.

Figure 3: Share of Total Retail Sales Made Online in the UK (%)

Source: Statista (2023c, n.p.)

Similarly, the offline presence strategy of BHS could be recognised as highly ineffective considering the fact that two-thirds of its stores had no new tenants one year after its retail failure (Wood, 2017b). This outcome strongly suggests that this brand had an excessive amount of floor space for its financial situation while also occupying areas with low customer traffic. With physical sales declining during this period due to the changing consumer habits, similar trends were seen in the case of such failing companies as Woolworths with most of its 800 stores standing unoccupied for several years after its closure (Taylor and Perkins, 2021). The inability to recognise this situation and optimise the physical presence of BHS could be seen as an additional strategic flaw of this brand.

3.4. Leadership and Governance Quality

The government report based on the large-scale investigation of BHS retail failure primarily attributes it to ‘personal greed’ and ‘leadership failures’ (Grima and Boztepe, 2021). The involved stakeholders were shifting the blame to other parties with both Sir Philip Green and Dominic Chappell being accused of extracting hundreds of millions of GBP from this brand. More specifically, its pension fund containing £5 in surplus in 2000 had a budget deficit of more than £571 million at the moment of BHS sale for a suspicious price of £1. At the same time, the new acquirer, Dominic Chappell, was overly optimistic and subject to managerial myopia and personal gratification in their management of the acquired assets (Bhaskar and Flower, 2021). Overall, the situation strongly implies that both owners were reckless in their corporate governance strategies and largely used BHS as a source of short-term revenues without considering the long-term implications of their actions. For example, Sir Philip Green awarded their own parent company a hefty sum of £423 million in the 2002-2004 period. Such practices are generally viewed as poor governance ignoring the interests of all involved stakeholders due to biased decision-making favouring a single party.

However, the analysed period was also characterised by the failure of many UK retail brands including Debenhams, Miss Selfridge, Peacocks, Topshop, and Topman (Parkinson, 2018). In other industries and geographic regions, such market leaders as Blockbuster, Carillion, and Kodak lost their leadership positions and filed for bankruptcy due to their inability to continue their operations. These issues were largely associated with poor leadership, managerial myopia, the lack of attention to disruptive innovation trends, sub-optimal accounting practices, and corporate greed hiding the actual financial position from many internal and external stakeholders (Solomon, 2020). The BHS investigation has informed the introduction of many governance best practices including independent director boards and other strategies ensuring high-quality decision-making in major corporations and reducing the possibility of unsupervised funds withdrawal by individual parties.

4. Conclusion

The performed analysis of the causes of BHS’ retail failure suggests that poor governance practices and irresponsible leadership decisions may not account for all significant factors leading to this outcome (Hayes, 2018). While they are frequently deemed key antecedents in this situation, the brand in question had a number of problematic background characteristics. They included poor brand positioning, ineffective STP choices, the absence of a unique service proposition, and sub-optimal choices of marketing and sales channels. It can also be noted that similar problems were shared by a large number of UK organisations in the retail sector and other industries that also filed for bankruptcy during the same period (Parkinson, 2018). In this aspect, the findings have informed a number of practical recommendations that can help other brands increase their resilience in a turbulent market environment. First, close attention must be paid to financial indicators and the optimisation of the brand’s physical presence. The increasing interest in online sales can help organisations decrease their rental costs and optimise their marketing operations by adopting an omni-channel strategy (Solomon, 2020). Second, changing consumer needs imply that brands must maintain close contact with their clients to learn more about them. The rapid obsolescence of BHS and other retail brands in the 2010s demonstrates that the lack of attention to this sphere can be extremely dangerous (Johnson, 2019). On the contrary, the companies embracing this concept, such as M&S, have successfully survived multiple crises and have developed a sustainable competitive advantage and a unique and instantly recognisable brand image.

This PhD essay sample is one example of how you can write an essay as part of your PhD qualification. No matter the topic or requirement of the PhD essay, you must demonstrate a deep understanding of the topic, research and data. Are you looking for help writing a PhD essay? Get help today from Original PhD’s academic writing experts by contacting us or placing an order.

References

Amankwah-Amoah, J., Khan, Z. and Wood, G. (2021) “COVID-19 and business failures: The paradoxes of experience, scale, and scope for theory and practice”, Elsevier Public Health Emergency Collection, 39 (2), pp. 179-184.

Atkinson, E. (2016) “Who is Mrs M&S”, [online] Available at: https://www.bbc.com/news/uk-36380151 [Accessed on 9 March 2023].

Bhaskar, K. and Flower, J. (2021) Disruption in Financial Reporting: A Post-Pandemic View of the Future of Corporate Reporting, London: Routledge.

Driver, C. and Thompson, G. (2018) Corporate Governance in Contention, Oxford: Oxford University Press.

Grima, S. and Boztepe, E. (2021) Contemporary Issues in Public Sector Accounting and Auditing, New York: Emerald Group Publishing.

Hayes, J. (2018) The Theory and Practice of Change Management, London: Bloomsbury Publishing.

Johnson, G. (2019) Exploring Strategy, Text and Cases, London: Pearson.

Liu, W. and Si, S. (2022) “Disruptive Innovation in the Context of Retailing: Digital Trends and the Internationalization of the Yiwu Commodity Market”, Sustainability, 14 (1), pp. 1-13.

Morris, R. (2018) Early Warning Indicators of Corporate Failure: A Critical Review of Previous Research and Further Empirical Evidence, London: Routledge.

Osborne, H. (2011) “Store Wars: BHS and Marks & Spencer”, [online] Available at: https://www.theguardian.com/money/poll/2011/oct/14/store-wars-bhs-marks-spencer [Accessed on 9 March 2023].

Parkinson, M. (2018) Corporate Governance in Transition: Dealing with Financial Distress and Insolvency in UK Companies, Berlin: Springer.

Pilkington, M. (2019) Retail Therapy: Why The Retail Industry Is Broken – And What Can Be Done to Fix It, London: Bloomsbury Publishing.

Porter, M. (1980) Competitive Strategy: Techniques for Analyzing Industries and Competitors, New York: Free Press.

Shah, O. (2018) Damaged Goods: The Rise and Fall of Sir Philip Green, London: Penguin.

Solomon, J. (2020) Corporate Governance and Accountability, Hoboken: John Wiley & Sons.

Statista (2023a) “Bhs products ranked by number of consumers in the United Kingdom (UK) from 2013 to 2016, by clothing product category”, [online] Available at: https://www.statista.com/statistics/312673/bhs-products-purchased-uk-by-clothing-product-type/ [Accessed on 9 March 2023].

Statista (2023b) “E-commerce revenue in the United Kingdom (UK) from 2015 to 2021 (in billion British pounds)”, [online] Available at: https://www.statista.com/statistics/282162/e-commerce-annual-sales-in-the-united-kingdom-uk/ [Accessed on 9 March 2023].

Statista (2023c) “Share of total retail sales made online in Great Britain from 2010 to 2022”, [online] Available at: https://www.statista.com/statistics/825461/proportion-of-retail-sales-made-online-great-britain-total/ [Accessed on 9 March 2023].

Taylor, S. and Perkins, G. (2021) Work and Employment in a Changing Business Environment, London: Kogan Page Publishers.

Tricker, B. (2019) Corporate Governance: Principles, Policies, and Practices, Oxford: Oxford University Press.

Wood, J. (2017a) “M&S delivers – but is it too late?”, [online] Available at: https://uk.news.yahoo.com/m-delivers-too-140633069.html [Accessed on 9 March 2023].

Wood, Z. (2017b) “Two-thirds of BHS stores lie empty as anniversary of collapse nears”, [online] Available at: https://www.theguardian.com/business/2017/apr/16/two-thirds-of-bhs-stores-lie-empty-as-anniversary-of-collapse-nears [Accessed on 10 March 2023].

Wright, M., Amess, K., Bacon, N. and Siegel, D. (2018) The Routledge Companion to Management Buyouts, London: Routledge.

Yang, S., Kim, Y. and Choi, S. (2022) “How to Respond to Disruptive Innovation in Online Retail Platforms”, Journal of Open Innovation, 8 (1), pp. 1-27.